Transform your portfolio and make a positive impact on the world by considering non-financial information in your investment decisions.

Learn more about integrating ESG into investment decisions to join the movement towards sustainable investing and maximize your financial returns while aligning with your values.

Table of Contents

Why Integrate ESG into Investment Decisions?

As the world becomes increasingly aware of the impact of business practices on the environment, society, and governance, the investment community is recognizing the importance of considering non-financial information when making investment decisions.

Integrating ESG factors into the investment process involves considering information related to a company’s environmental impact, labor practices, governance structure, and other social factors, in addition to traditional financial metrics such as earnings and revenue.

The integration of ESG factors into the investment process is driven by a growing recognition of the impact that business practices can have on long-term financial performance.

Companies with poor environmental practices, for instance, may face increased regulation, fines, and reputational damage, while companies with solid labor practices may be more attractive to employees and customers.

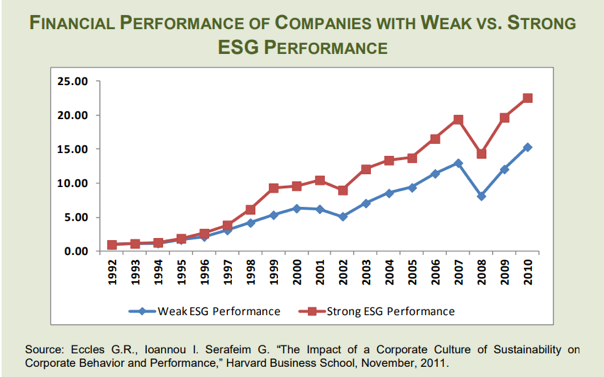

Research also suggests that companies with strong ESG practices tend to outperform their peers over the long term. In addition, integrating ESG into the investment decisions can align an investor’s portfolio with its values and goals.

For example, an investor who is concerned about climate change may want to invest in companies that are taking steps to reduce their carbon footprint, while an investor who values corporate responsibility may be more likely to invest in companies with strong labor practices.

Methods of Integrating ESG into Investment Decisions

There are several methods for integrating ESG into the investment process, each with its own advantages and disadvantages.

The specific approach will depend on an investor’s goals and resources, but some standard methods include the following:

Benefits of Integrating ESG into Investment Decisions

Challenges of Integrating ESG into Investment Decisions

Conclusion

Integrating ESG into the investment process is a crucial step toward responsible and sustainable investing.

By considering non-financial information, such as a company’s impact on the environment, society, and governance, investors can make informed decisions that align with their values and goals while also potentially enhancing long-term financial returns.

The best practices for integrating ESG into the investment process include assessing investment goals and values, using reputable ESG data sources, considering both financial and ESG factors, engaging with companies, and continuously monitoring and evaluating ESG data.

While integrating ESG into the investment process can be complex and time-consuming, it has the potential to drive positive change in the world and position investors for long-term success.

By embracing a holistic approach to investing that takes into account both financial and ESG considerations, investors can help to create a more sustainable and equitable future for all.

References:

- Klassen, K. J., & McLaughlin, P. (2016). The impact of corporate sustainability on organizational processes and performance. Review of Financial Studies, 29(11), 2885-2918.

- Serafeim, G. (2013). The performance frontier: Innovating for a sustainable strategy. Harvard Business Review, 91(5), 56-64.

- Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization studies, 24(3), 403-441.

- ESG investing: everything you need to know about it | Sleek. https://sleek.com/au/resources/esg-investing/

- Problems with ESG: holding companies accountable and faulty assessment …. https://www.coolset.com/academy/problems-with-esg-holding-companies-accountable-and-faulty-assessment-systems

- Editorial: Emotional and social value of organizations. https://addi.ehu.es/bitstream/handle/10810/59586/fpsyg-13-1064540.pdf