ESG Integration Framework is an innovative approach that considers Environmental, Social, and Governance factors to help you make informed decisions that align with your values and beliefs.

With ESG integration, you’ll be able to assess the long-term risks and opportunities posed by ESG issues and turn your investments into a force for good.

Get started now and join the movement toward a more sustainable future!

Table of Contents

What Are ESG Factors?

ESG factors have become increasingly relevant in the investment world as investors seek to align their portfolios with their values and understand the long-term risks and opportunities posed by these issues.

ESG factors refer to a range of non-financial metrics that can impact a company’s financial performance and long-term viability.

In this article, we will explore what ESG factors are and why they are important for investors to consider.

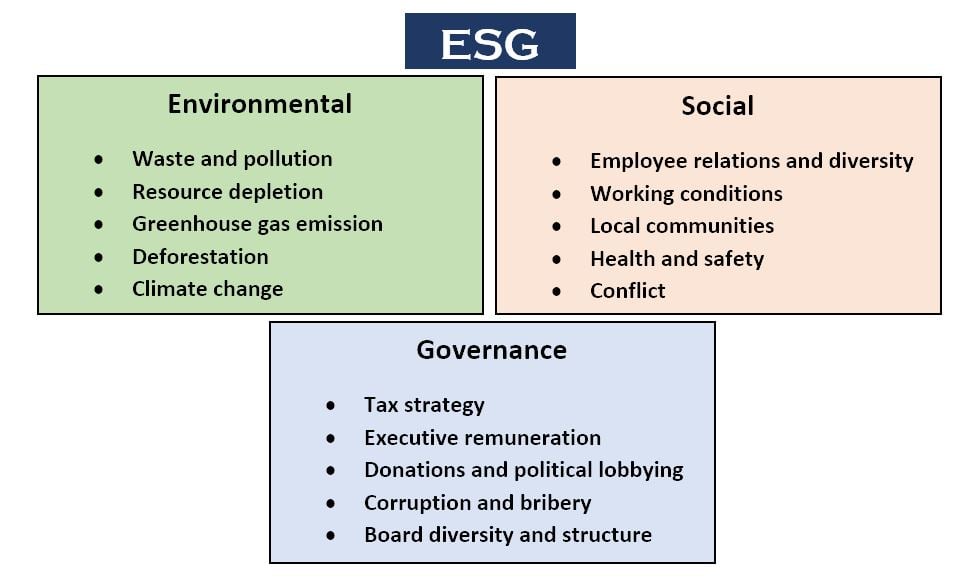

Environmental factors refer to a company’s impact on the natural environment and its efforts to reduce its carbon footprint and promote sustainability. This includes issues such as greenhouse gas emissions, waste management, and water usage.

Companies that are leaders in sustainability tend to be more innovative, less vulnerable to environmental risks, and more responsive to the needs of their customers and stakeholders.

Social factors refer to a company’s impact on society and its employees, including issues such as workplace diversity and human rights.

Companies that have a positive impact on society and their employees tend to have higher employee morale, better brand reputation, and more loyal customers.

Additionally, companies that are known for treating their employees well are more likely to attract and retain top talent.

Governance factors refer to the way a company is run and managed, including issues such as executive compensation, board structure, and corporate transparency.

Companies that have strong governance practices are more likely to be well- managed, have a clear strategic direction, and be transparent with their stakeholders.

This can lead to improved financial performance and reduced risk for investors.

Key Steps in the ESG Integration Framework

The first step in the ESG integration process is to identify the ESG issues that are most relevant to a particular investment opportunity. This may involve reviewing publicly available information, engaging with companies, and consulting with experts.

It is important to understand the ESG factors that are most important for a particular company or industry in order to ensure that relevant ESG considerations are taken into account in the investment analysis.

Once relevant ESG issues have been identified, the next step is to assess the risks and opportunities associated with these issues. This may involve analyzing a company’s historical performance on ESG issues, as well as its future plans and initiatives.

It is important to consider both the short-term and long-term impacts of ESG factors on a company’s financial performance in order to fully understand the potential risks and opportunities associated with a particular investment opportunity.

Once the risks and opportunities associated with ESG factors have been assessed, the next step is to integrate this information into the overall investment analysis.

This may involve adjusting financial models to incorporate the potential impacts of ESG factors on a company’s financial performance, as well as considering ESG factors in the valuation of a company or security.

It is important to ensure that ESG considerations are integrated into all aspects of the investment analysis in order to provide a complete and accurate picture of a company’s financial performance and long-term viability.

The final step in the ESG integration process is to regularly monitor and review the investment in order to ensure that ESG considerations continue to be incorporated into investment decisions.

This may involve engaging with companies to understand their ESG performance and monitoring regulatory developments and other factors that may impact ESG performance over time.

Regular monitoring and review help to ensure that ESG considerations remain relevant and up-to-date and that any changes in a company’s ESG performance are taken into account in investment decisions.

By following the steps in the ESG integration framework, investors can ensure that they are incorporating ESG considerations into their investment decisions in a systematic and structured manner.

This helps to better understand the risks and opportunities associated with ESG factors and to make more informed investment decisions that align with an investor’s values and beliefs.

Additionally, incorporating ESG considerations into investment decisions can help to promote positive social and environmental outcomes and to ensure that investments generate sustainable returns over the long term.

Benefits of ESG Integration

One of the primary benefits of ESG integration is that it helps investors better understand the risks and opportunities associated with a particular investment opportunity.

By considering ESG factors, investors can gain a complete understanding of the long-term viability of a company and its ability to generate sustainable returns.

Another key benefit of ESG integration is that it can help to improve ESG performance over time.

By engaging with companies on ESG issues, investors can help to identify opportunities for improvement and to drive better ESG performance.

This can result in more sustainable investment and better outcomes for both the company and its stakeholders.

Many investors want their portfolios to reflect their values and beliefs, and ESG integration provides a way to align investments with personal values.

By incorporating ESG considerations into investment decisions, investors can ensure that their portfolios reflect their values and promote positive social and environmental outcomes.

Finally, ESG integration can help to promote positive social and environmental outcomes.

By considering ESG factors in investment decisions, investors can promote companies that prioritize sustainability, employee well-being, and responsible governance, ultimately leading to a more sustainable future for all stakeholders.

ESG integration is a valuable tool for investors who seek to understand the risks and opportunities posed by ESG factors, align their portfolios with their values, and promote positive social and environmental outcomes.

By considering ESG factors in investment decisions, investors can make more informed investment choices and promote a more sustainable future for all stakeholders.

Resume

Introduction

- Environmental, social, and governance (ESG) factors have gained increased attention in the investment world.

- ESG integration framework helps investors to systematically assess and incorporate ESG considerations into investment decisions

What are ESG Factors?

- ESG factors refer to a range of non-financial metrics that can impact a company’s financial performance and long-term viability

- Environmental factors: impact on the environment and sustainability efforts

- Social factors: impact on society and employees, workplace diversity, and human rights

- Governance factors: how a company is run, executive compensation, board structure, and corporate transparency

Steps in the ESG Integration Framework

Benefits of ESG Integration

- A better understanding of risks and opportunities

- Improved ESG performance over time

- Aligns portfolio with values and beliefs

- Promotes positive social and environmental outcomes

Conclusion

- ESG integration provides a structured approach to incorporating ESG considerations into investment decisions

- Helps investors make informed investment decisions and align portfolios with values and beliefs

- This leads to better ESG performance over time and promotes positive social and environmental outcomes

Conclusion

The ESG integration framework is a valuable tool for investors looking to incorporate Environmental, Social, and Governance (ESG) considerations into their investment decisions.

The framework provides a structured approach to identifying ESG issues, assessing ESG risks and opportunities, integrating ESG factors into investment analysis, and monitoring and reviewing investments.

By following this framework, investors can gain a better understanding of the risks and opportunities associated with ESG factors and make more informed investment decisions.

The benefits of ESG integration are numerous, including a better understanding of risks and opportunities, improved ESG performance over time, alignment of portfolios with values and beliefs, and promotion of positive social and environmental outcomes.

As ESG considerations continue to gain importance in the investment world, the ESG integration framework is becoming increasingly relevant for investors seeking to make responsible, sustainable, and impactful investments.