ESG in banking is a game-changer that’s transforming the industry.

By integrating sustainable practices, promoting diversity, and managing climate risks, banks can prove their commitment to social responsibility, enhance their reputation, and attract loyal customers and investors.

It’s a win-win for everyone involved!

Table of Contents

Why ESG in Banking is Important?

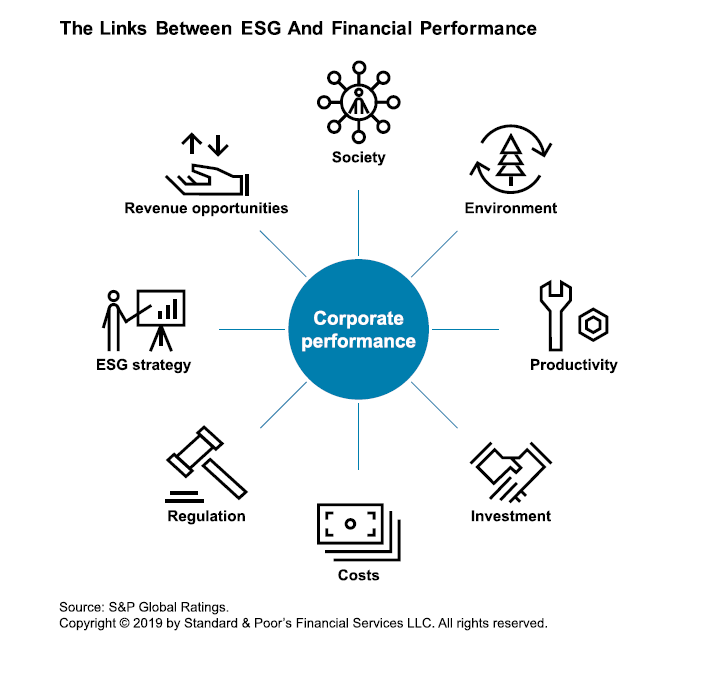

ESG (Environmental, Social, and Governance) is becoming an increasingly important factor for banks as they strive to demonstrate their commitment to sustainability and social responsibility.

This matters for banks for several reasons:

How Are Banks Financing Sustainable Projects?

Why Diversity Matters in Banking?

Creating a diverse and inclusive banking sector is a critical challenge that banks must face to demonstrate their commitment to social responsibility and attract top talent.

While the financial sector has traditionally been male-dominated and lacking in diversity, banks are now recognizing the importance of promoting diversity and inclusion to foster innovation, increase employee engagement, and better serve their customers.

Creating a diverse and inclusive banking sector requires a multifaceted approach that involves implementing policies and initiatives that support diversity and inclusion in all aspects of the business.

This includes hiring practices that prioritize diversity, providing equal opportunities for career advancement, and creating a workplace culture that fosters inclusion and belonging.

Banks are taking various steps to promote diversity and inclusion, including creating employee resource groups, training and educating employees on unconscious bias and diversity topics, and implementing diversity targets and metrics to measure progress.

There are many benefits to building a more diverse and inclusive banking sector. These include a more engaged and innovative workforce, better alignment with customer needs, and improved financial performance.

Customers are increasingly looking to do business with companies that share their values, including a commitment to diversity and inclusion.

How Are Banks Preparing for The Future?

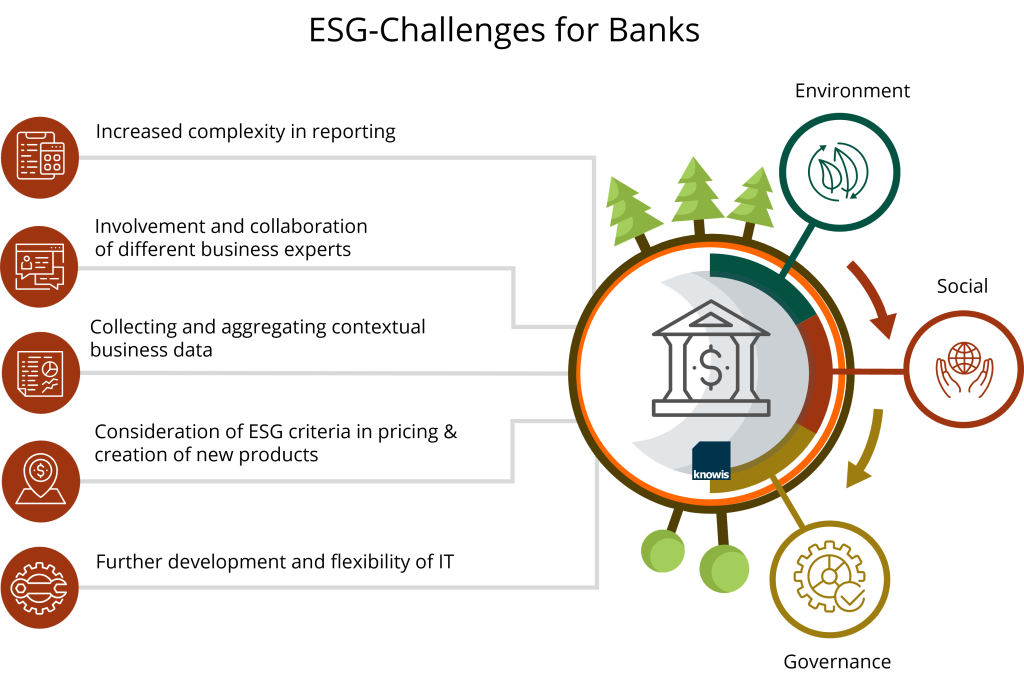

Managing climate risks is becoming increasingly important for banks as the impact of climate change on the financial sector becomes more apparent. Banks that fail to manage climate risks effectively may face reputational damage, financial losses, or regulatory action.

However, banks that take a proactive approach to managing climate risks can enhance their reputation, build resilience, and position themselves for long-term success.

Managing climate risks requires a multifaceted approach that involves identifying and assessing the potential risks, developing strategies to mitigate those risks, and monitoring and reporting on progress over time.

This can include measures such as stress testing, scenario analysis, and integrating climate risk management into investment decision-making.

Banks are taking various steps to manage climate risks, including setting targets for reducing their own carbon footprint, investing in sustainable projects, and working with clients to develop sustainable financing solutions.

Banks are also engaging with regulators, industry groups, and other stakeholders to develop best practices and collaborate on climate risk management initiatives.

There are many benefits to managing climate risks, including improved resilience, enhanced reputation, and better alignment with customer needs.

Customers and investors are increasingly looking to do business with companies that are taking meaningful action on climate change, making climate risk management an important consideration for banks.

ESG in Banking Positives & Negatives

Positives:

Negatives:

Conclusion

In the end, the verdict is clear: ESG (Environmental, Social, and Governance) is a game-changer for the banking industry.

While there are some potential pitfalls, the benefits of prioritizing sustainability and social responsibility in banking are too great to ignore.

By positioning themselves as responsible, innovative, and committed to a better future, banks can attract customers, investors, and top talent and differentiate themselves in a competitive market. It’s time to embrace ESG and drive positive change, one sustainable investment at a time.